How to create a Liquidity Pair on a decentralized exchange

DeFi Basics - Liquidity Pools

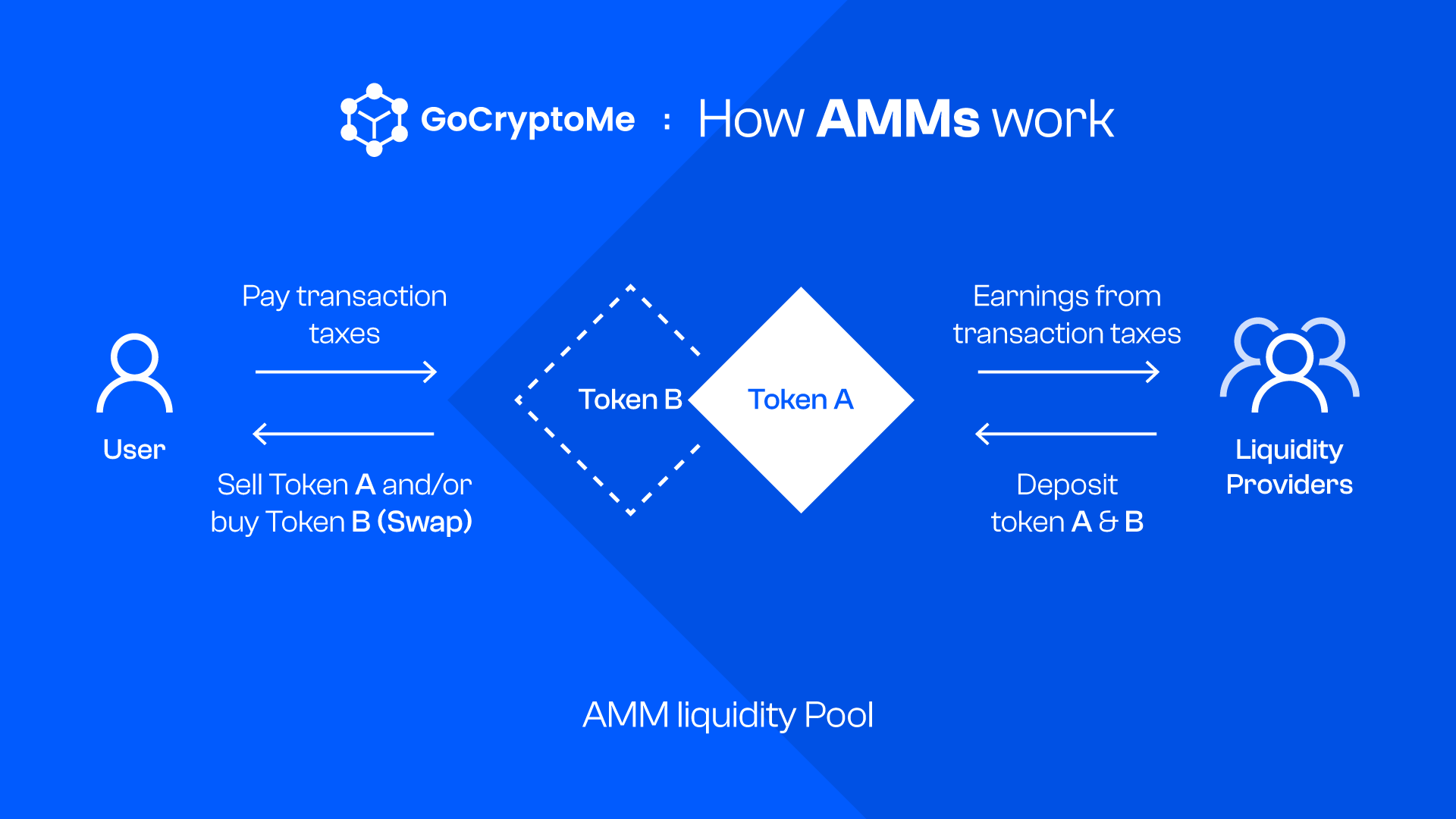

If you’ve ever swapped or traded cryptocurrency on a decentralized exchange like PancakeSwap or Uniswap, chances are you’ve used a Liquidity Pool. Almost every DEX (decentralized exchange) in the crypto world uses some form of a liquidity pool to allow users to instantly swap tokens without using a broker or intermediary.

In this guide we’re going to cover a few basics around liquidity pools. We’ll teach you the benefits and risks associated with being a liquidity provider, then show you step-by-step how to create a liquidity pair and deposit it into a pool to earn crypto rewards.

What is a Liquidity Pool?

A liquidity pool is simply a group of two or more crypto tokens that people can use to instantly swap tokens using the blockchain. For example, if you want to buy $GCME using your $BNB you can give your BNB tokens to Liquidity Pool and receive $GCME tokens in return.

Every time you exchange tokens with a liquidity pool, you alter the ratio of tokens within the pool. This can cause a change in the price of the tokens in the pool. This is called Price Impact.

To demonstrate this effect, imagine a liquidity pool with two tokens called A and B. If we create the pool using 100 A tokens and 10 B tokens, then according to the pool 1 B token has the same value as 10 A tokens (1B=10A). For the sake of simplicity, imagine the total value of the pool is $1,000. Because we need to provide an equal value of each token, that means that Token A =$5 and Token B=$50.

If we want to buy more B tokens, we need to exchange A tokens in our wallet for B tokens in the pool. Let’s say we want to buy 5 B tokens, that means we need to exchange 50 A tokens given the ratio of tokens in the pool. After our swap is completed, there will be 150 A tokens and just 5 B tokens. According to the pool, 1 B token now has the same value as 30 A tokens (1B=30A).

As you can see, large token purchases can significantly change the ratio of tokens in the pool and the value of the assets. Fortunately, all these complex equations and formulas are calculated automatically behind the scenes. All these values will be clearly displayed on the decentralized exchange you’re using to ensure your token swap is as frictionless as possible.

Buying lots of tokens at once will result in high price impact and volatile increases and decreases in asset value. High price impact can be avoided by having deep liquidity pools with plenty of different providers.

It’s almost always safer to have lots of liquidity providers contributing to a liquidity pool than to have one large, centralized liquidity source. If most of the tokens in a liquidity pool are owned by a single entity, they can easily withdraw their liquidity at any time and destabilize the pool. Having a diversified group of liquidity providers helps to spread out and decentralize token liquidity, ensuring safer trading and reducing investment risk. For this reason, many decentralized exchanges offer generous incentives to liquidity providers to deepen their liquidity pools.

What is a Liquidity Provider?

For a liquidity pool to function correctly, someone needs to create a liquidity pair (LP) between 2 cryptocurrencies and deposit the newly-created LP token into a decentralized exchange like Pancakeswap or Uniswap. We call this a Liquidity Provider.

Liquidity Providers are incentivised to deposit their tokens into liquidity pools in a variety of ways. Every time someone exchanges tokens through a Liquidity Pool, a small transaction fee is collected. This fee is distributed to Liquidity Providers as a reward for contributing to the liquidity pool and allowing other users to swap tokens.

Some crypto projects also offer additional crypto tokens to liquidity providers as a reward for supporting their platform and growing their liquidity. In the wider world of decentralized finance, this is called yield farming, or liquidity mining, and is a popular way to earn extra cryptocurrency.

It’s important to know that even when you become a liquidity provider and deposit your tokens in a liquidity pool, you still have full control over your assets. In most cases, you can withdraw them whenever you like.

What are the Risks?

Despite having extensive benefits, becoming a liquidity provider is never without risk. One of the biggest issues liquidity providers can face is impermanent loss. Impermanent loss is caused by changes in the ratio of tokens in a pool and could result in a loss of funds.

To better understand impermanent loss, let’s use another made up example and imagine 1 BTC = 100 USDT at the time of deposit:

- We deposit 1 BTC and 100 USDT in a liquidity pool

- The pool has a total of 10 BTC and 1,000 USDT, funded by other liquidity providers like us

- We own a 10% share of the pool, which has a total liquidity of $10,000

- The price of BTC increases to 400 USDT, but USDT price stays the same

- Other crypto traders adjust the ratio of BTC and USDT in the pool to reflect the current market price

- We withdraw our funds, which are worth 400 USD

- If we had held onto our 1 BTC and 100 USDT instead, they would be worth 500 USD

In this example, we would have been better off holding onto our tokens from the beginning. Instead, we chose to deposit them into a liquidity pool, resulting in an impermanent loss from price change. While this may sound discouraging, impermanent loss is often mitigated by earnings made from transfer fees and yield farming rewards.

If you’re still scratching your head over what all this means, don’t worry! You are not alone. For most new users, Liquidity Pools and Impermanent Loss are complicated topics that are difficult to grasp. If you’re still struggling, please see our detailed breakdown of the ins and outs of impermanent loss.

How to Create a Liquidity Pair on PancakeSwap or Uniswap for $GCME

Now that we have a clear understanding of what liquidity pools are and how they work, let’s learn how to create a liquidity pair for $GCME. After creating our liquidity tokens, we can deposit them into pools to earn generous passive rewards in $GCME yield farms and help support the stability of the GoCryptoMe ecosystem.

To create a liquidity pair, you’ll need:

- A crypto wallet

- $GCME tokens on the Binance Smart Chain or the Ethereum Network

- An equal value of BNB or WETH to pair with

- BNB or WETH to pay blockchain gas fees

If this is your first time, please visit our convenient guides on how to create a crypto wallet and how to fund your crypto wallet using a credit card or from an exchange.

To buy $GCME tokens, follow our step-by-step guide to buying $GCME, or visit the GoCryptoMe DEX.

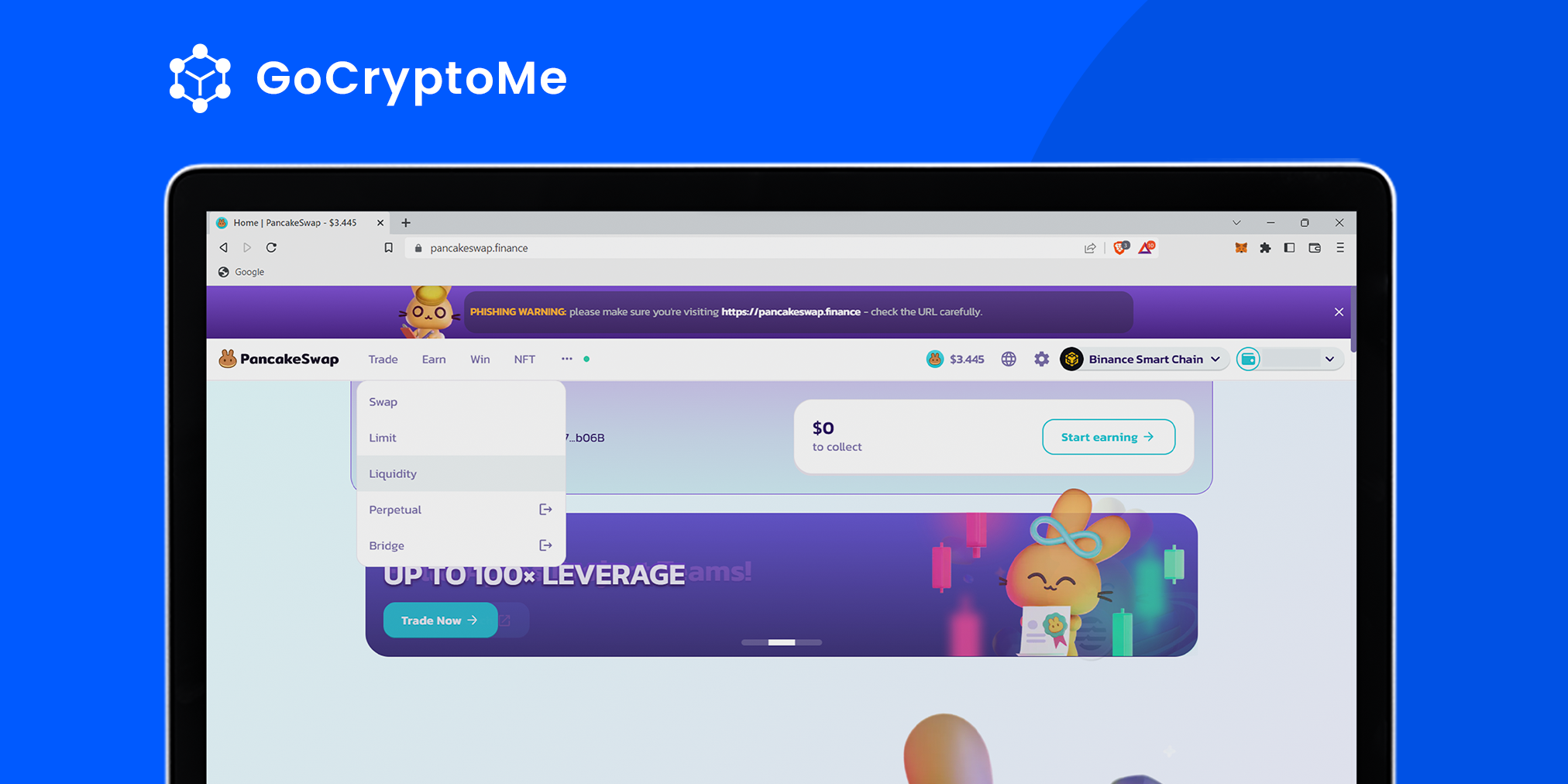

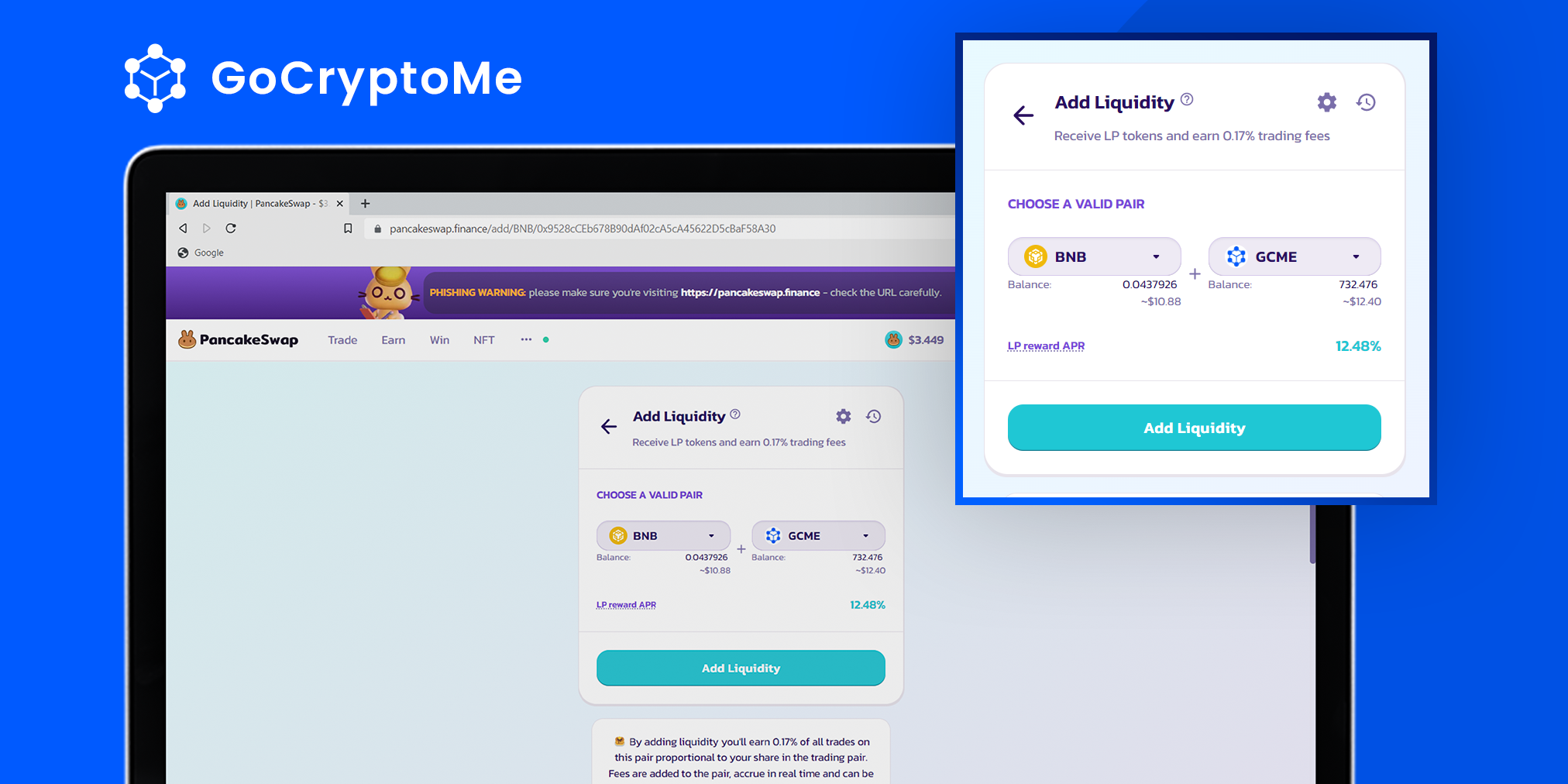

Step 1: Head to PancakeSwap or Uniswap

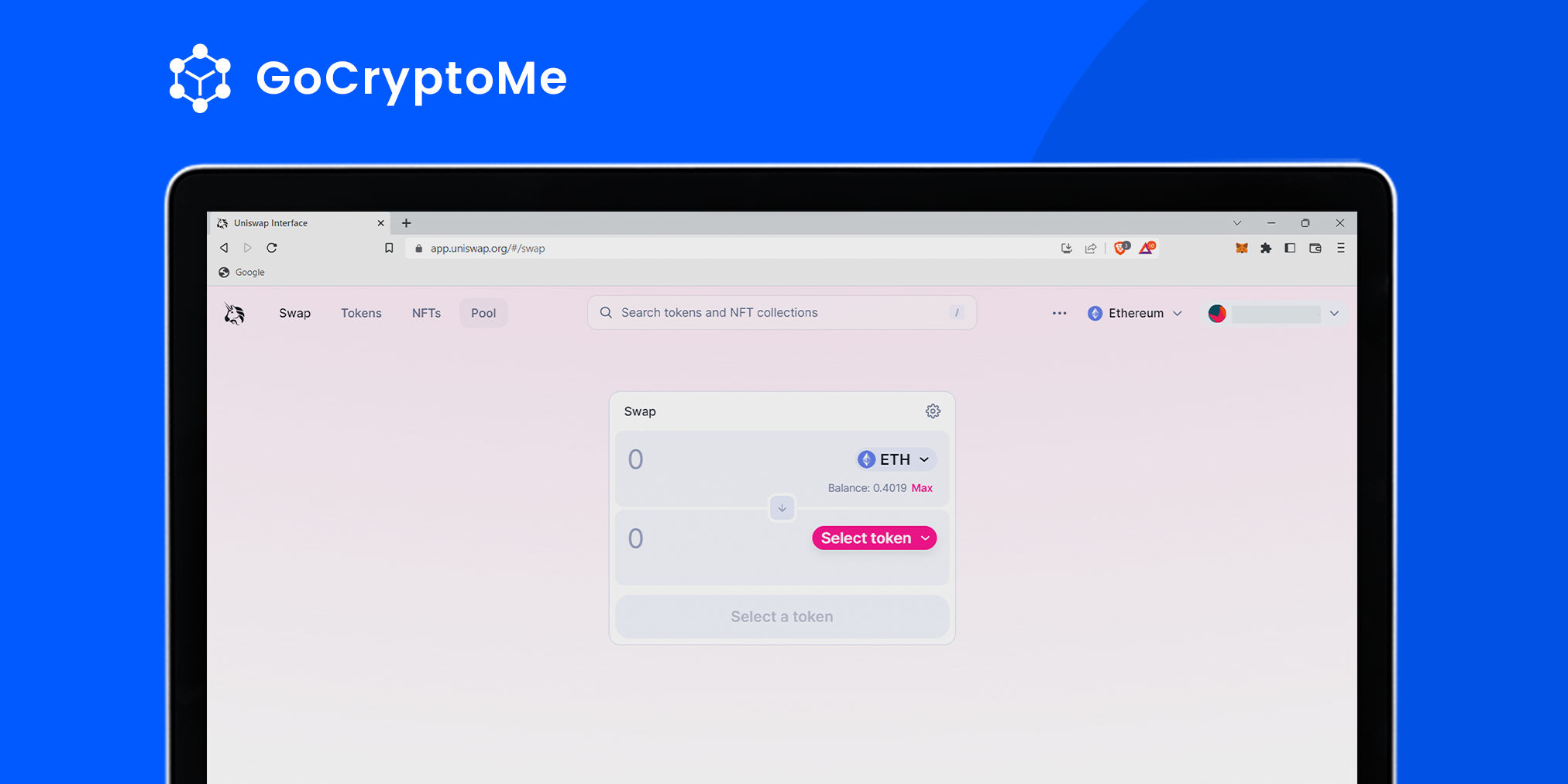

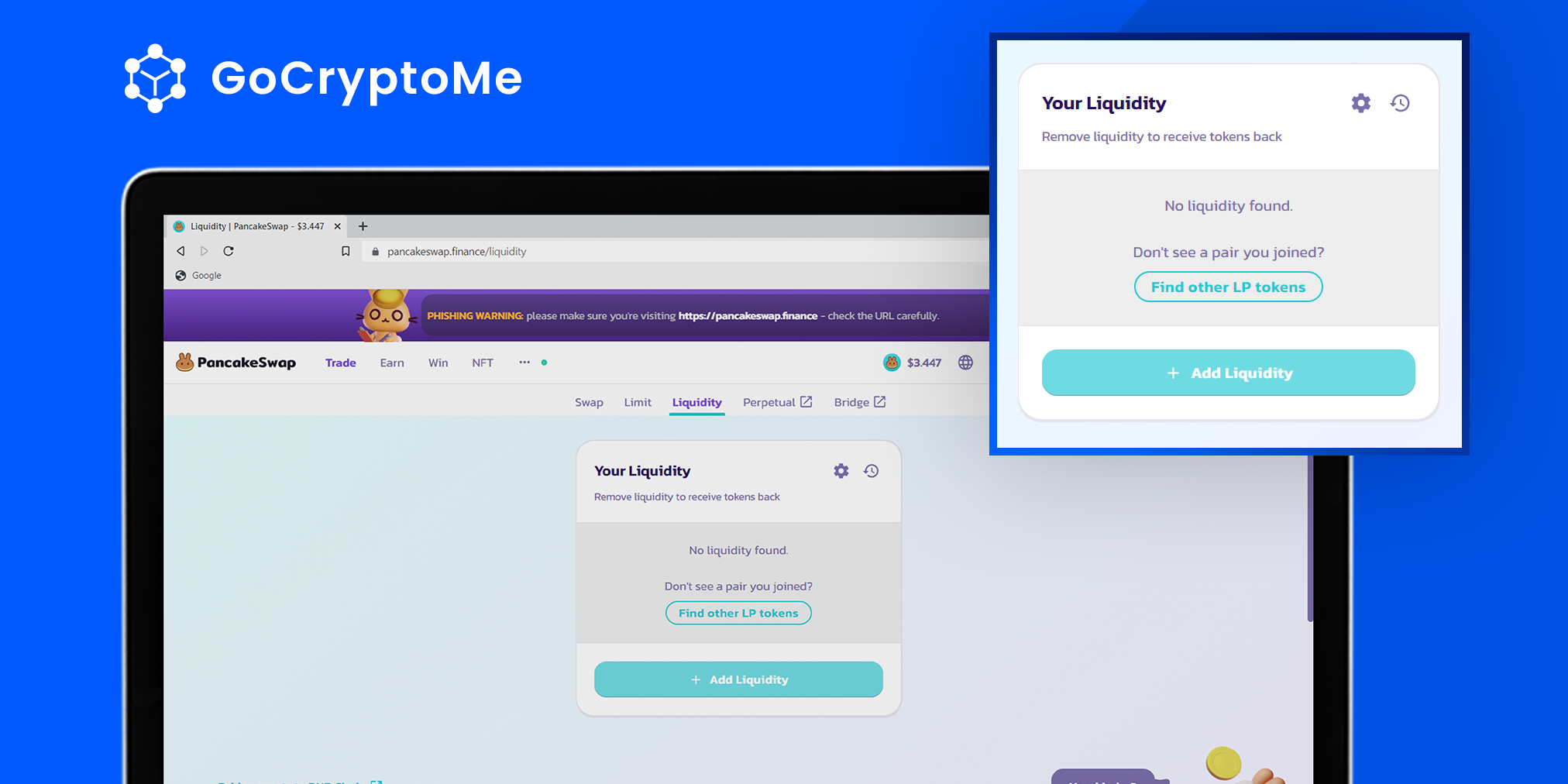

First, visit PancakeSwap (if on Binance Smart Chain) or Uniswap (if on Ethereum) and connect your crypto wallet. Then, find the liquidity provision section of their site. Hit ‘Liquidity’ under the ‘Trade’ tab on PancakeSwap or click ‘Pool’ on the Uniswap menu.

Step 2: Set up Liquidity Pair

For PancakeSwap, on the next page click ‘+Add Liquidity’ and select GCME and BNB or GCME and ETH using the fields provided. Then, click ‘Add Liquidity again.

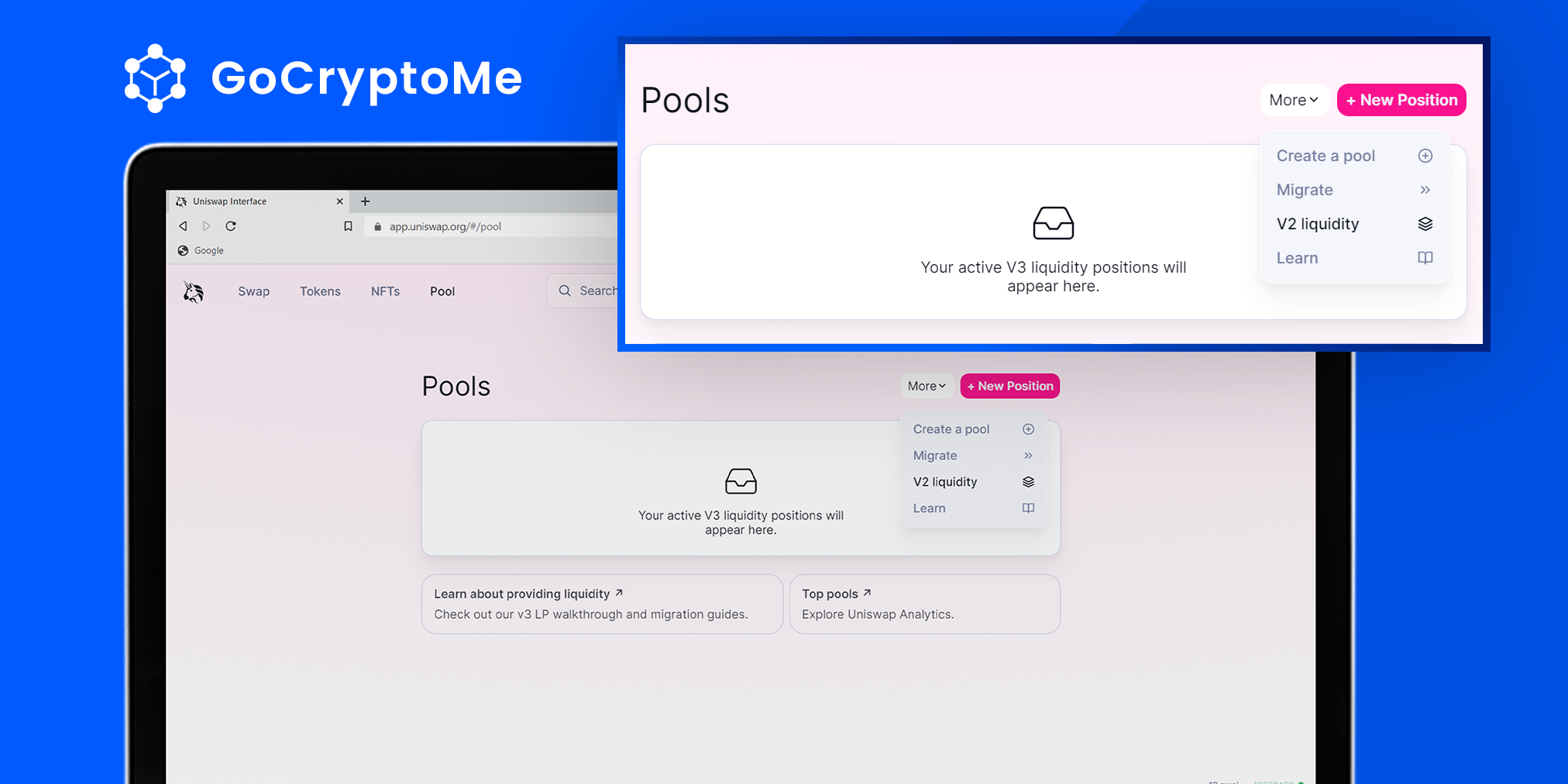

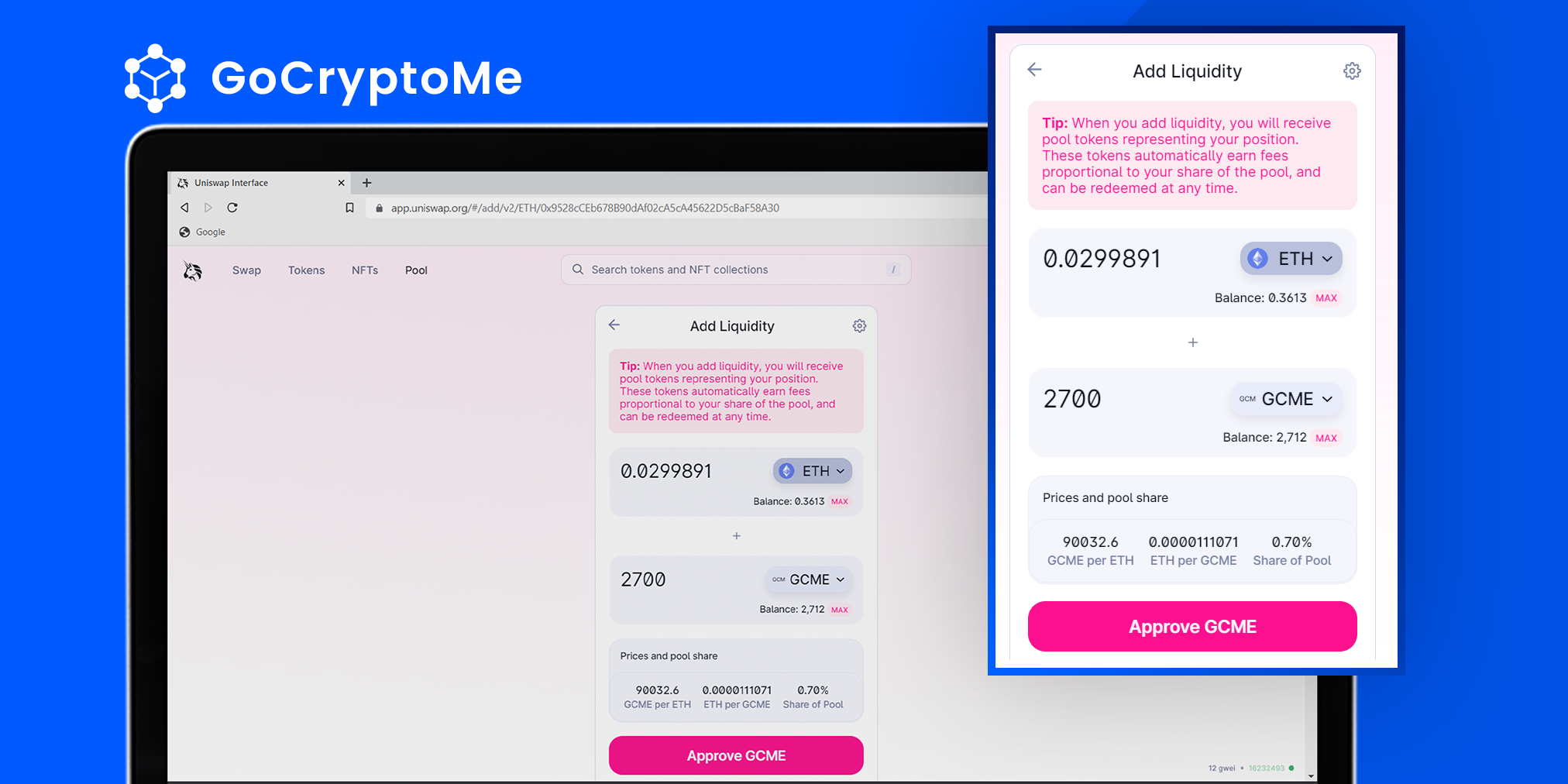

For Uniswap, the current GCME/ETH liquidity pool is hosted in UniSwap’s V2 liquidity format, as opposed to Uniswap’s default V3 format. To create a liquidity pair on Uniswap for GCME, you’ll need to visit Uniswap’s V2 platform. To do this, simply click ‘V2 Liquidity’ under the ‘More’ tab as demonstrated below.

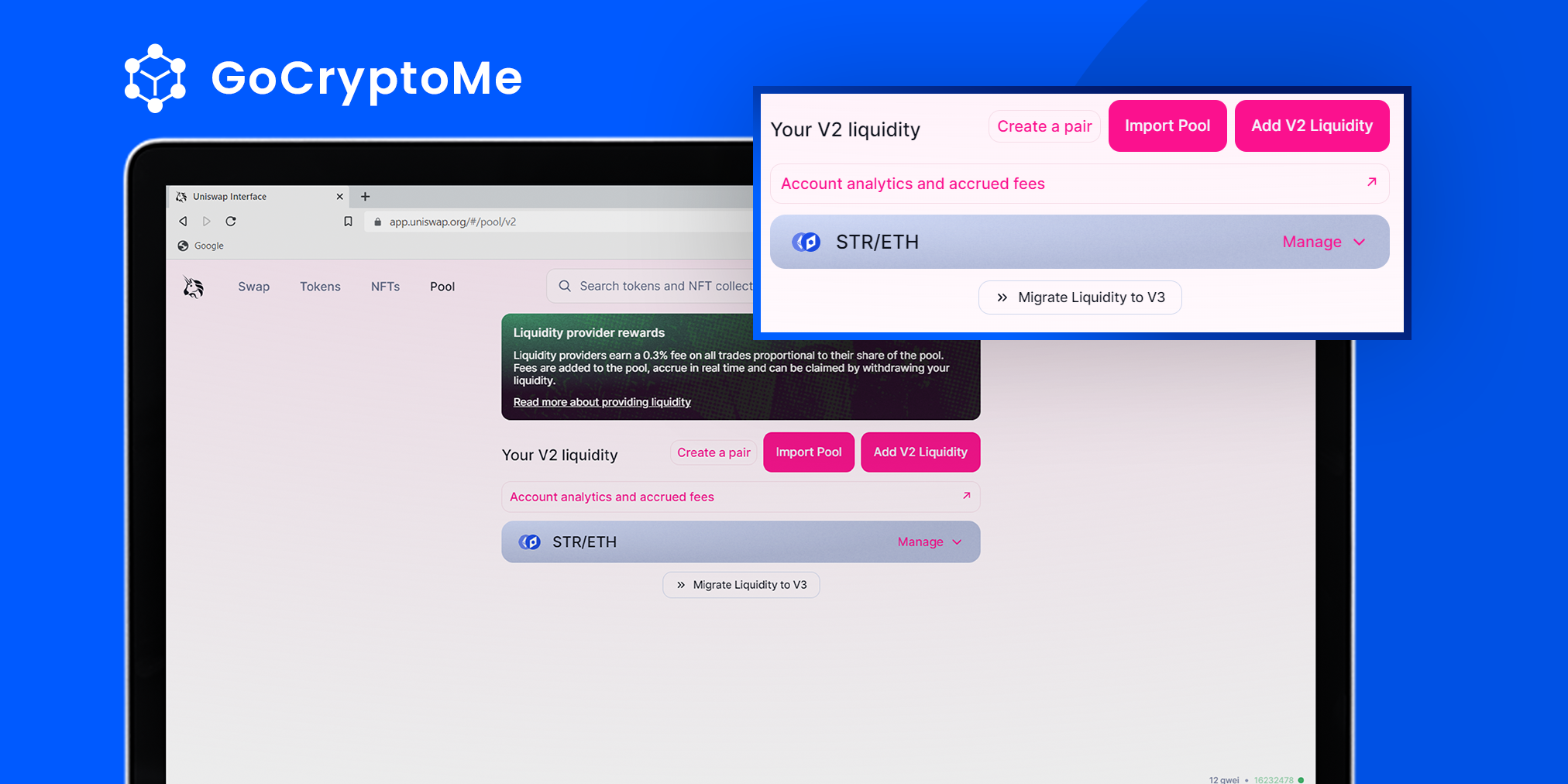

On the following page, click ‘Add V2 Liquidity’

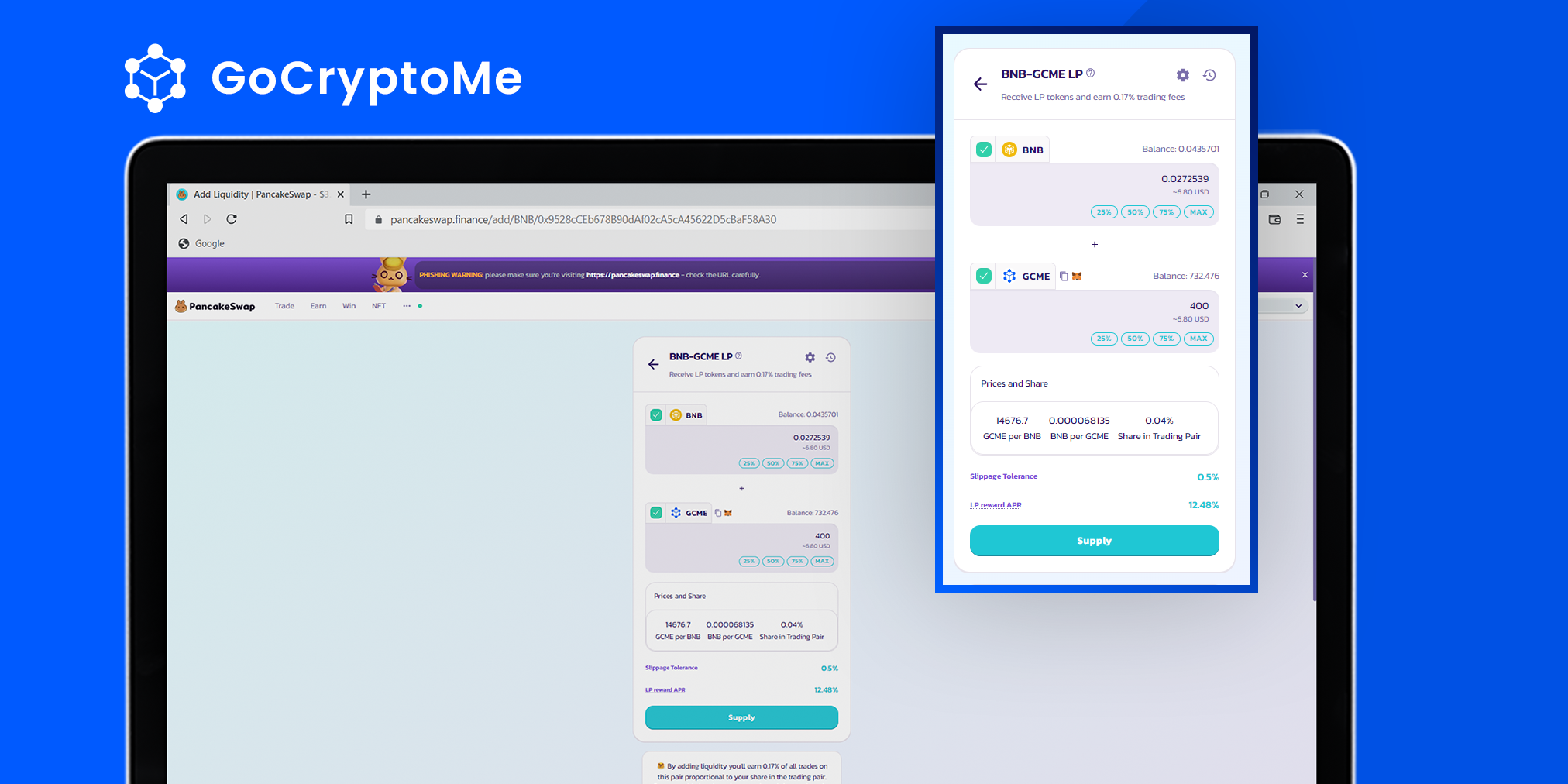

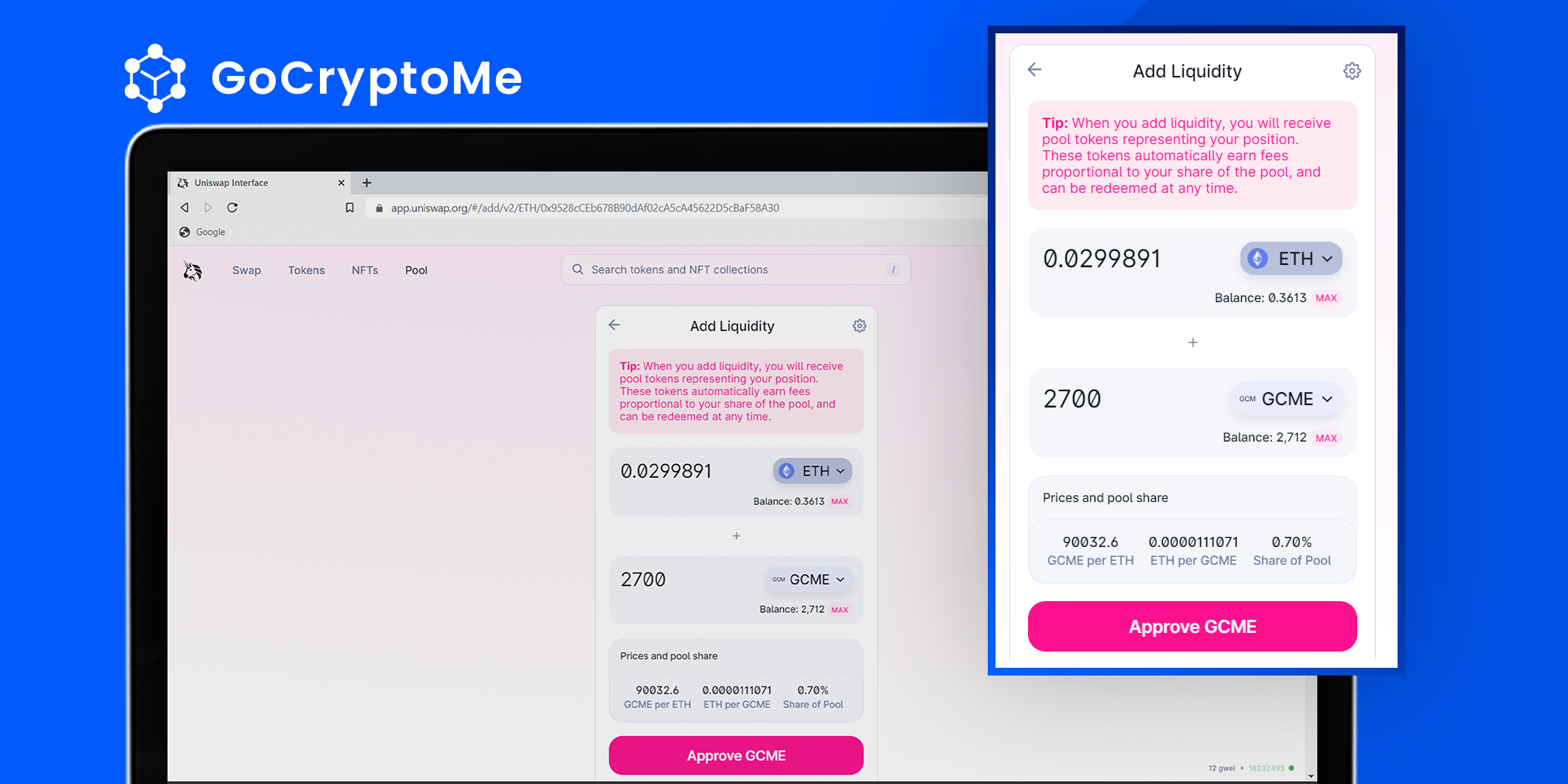

After selecting the tokens you’ll be using to create your liquidity pair, input the amount of each token you’d like to use. Please note you can only provide an equal value of tokens, denominated in USD. You’ll also need to save some BNB or ETH to pay for the gas fee.

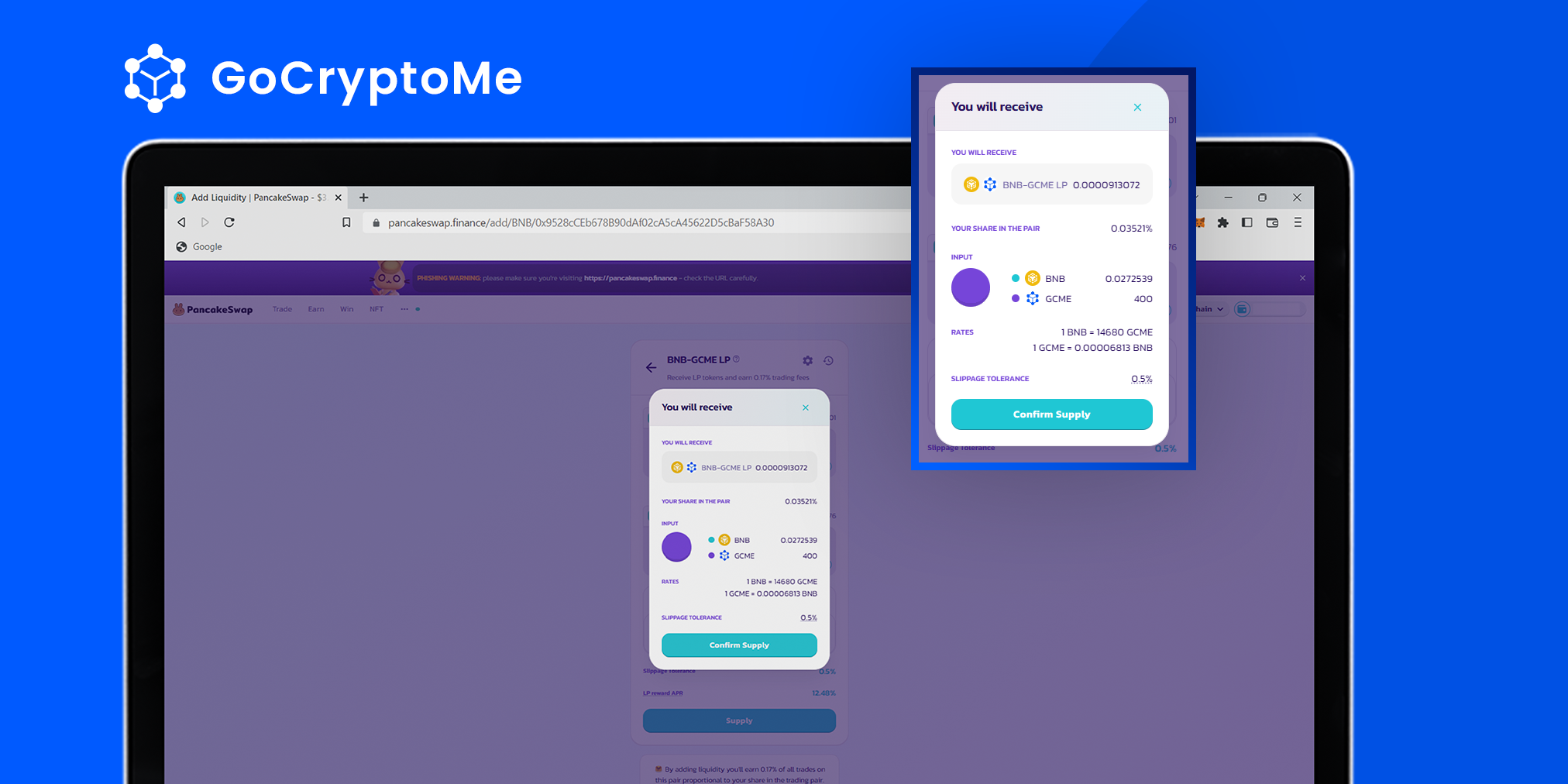

Step 3: Create Liquidity Pair

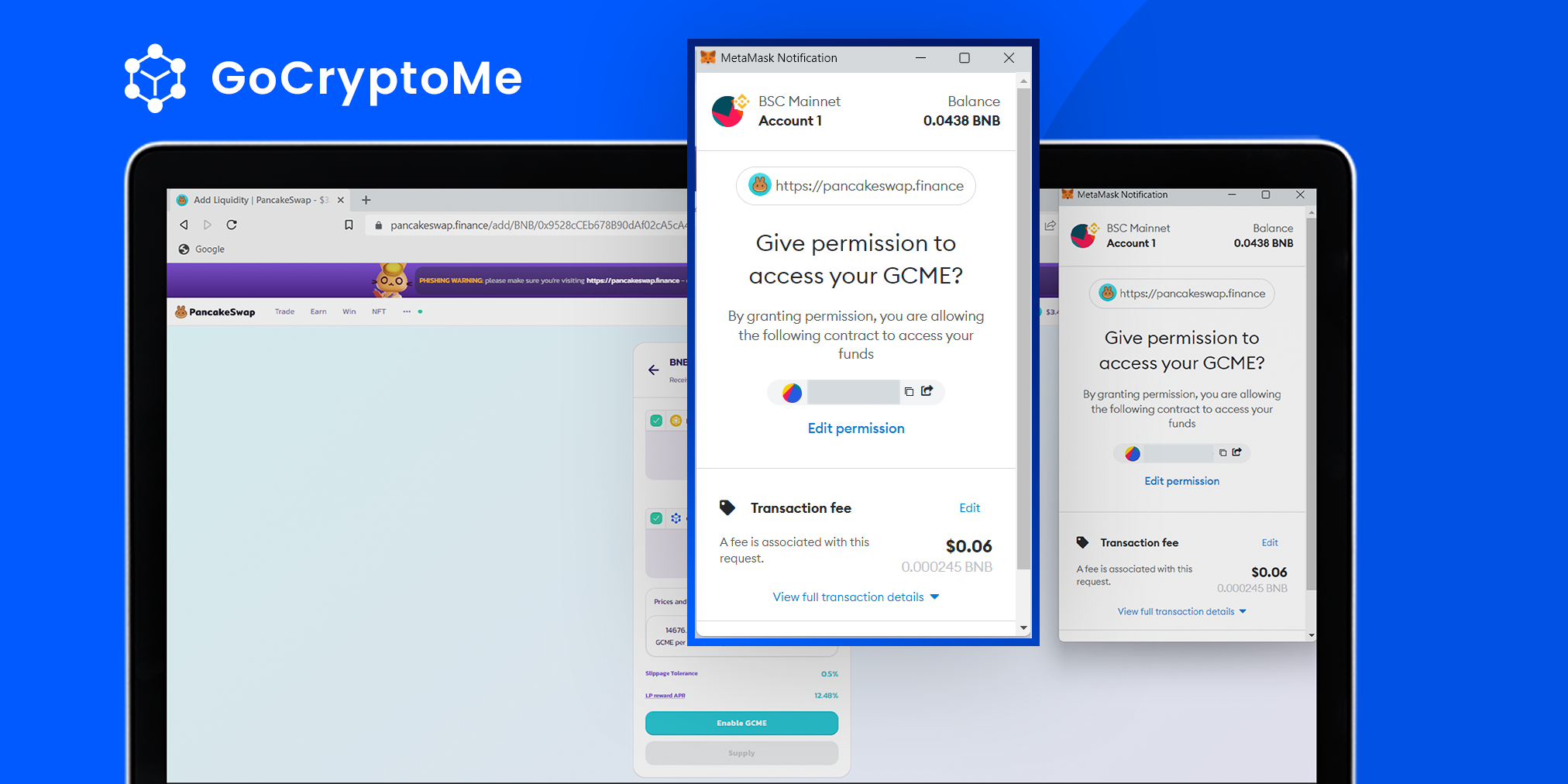

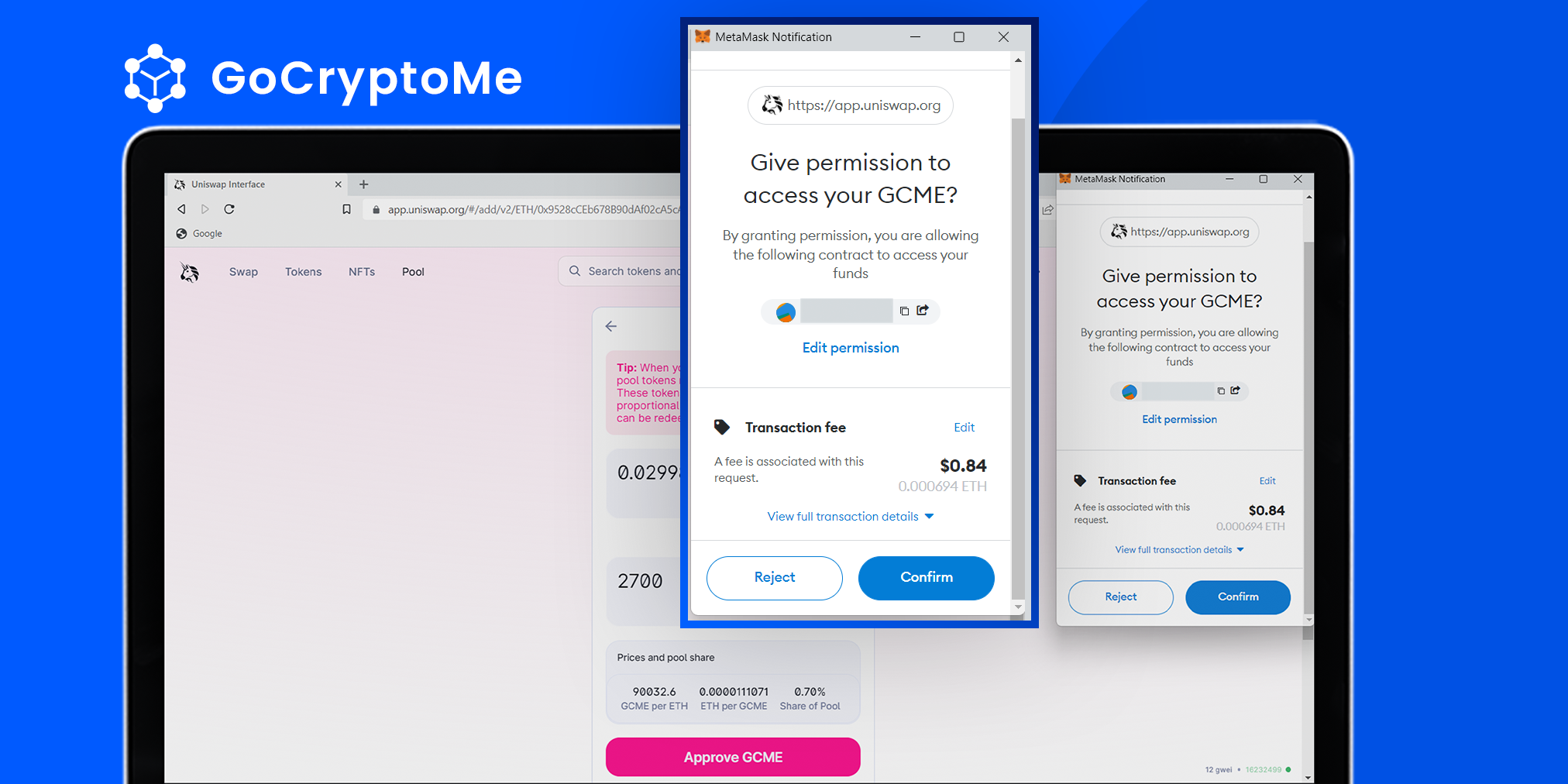

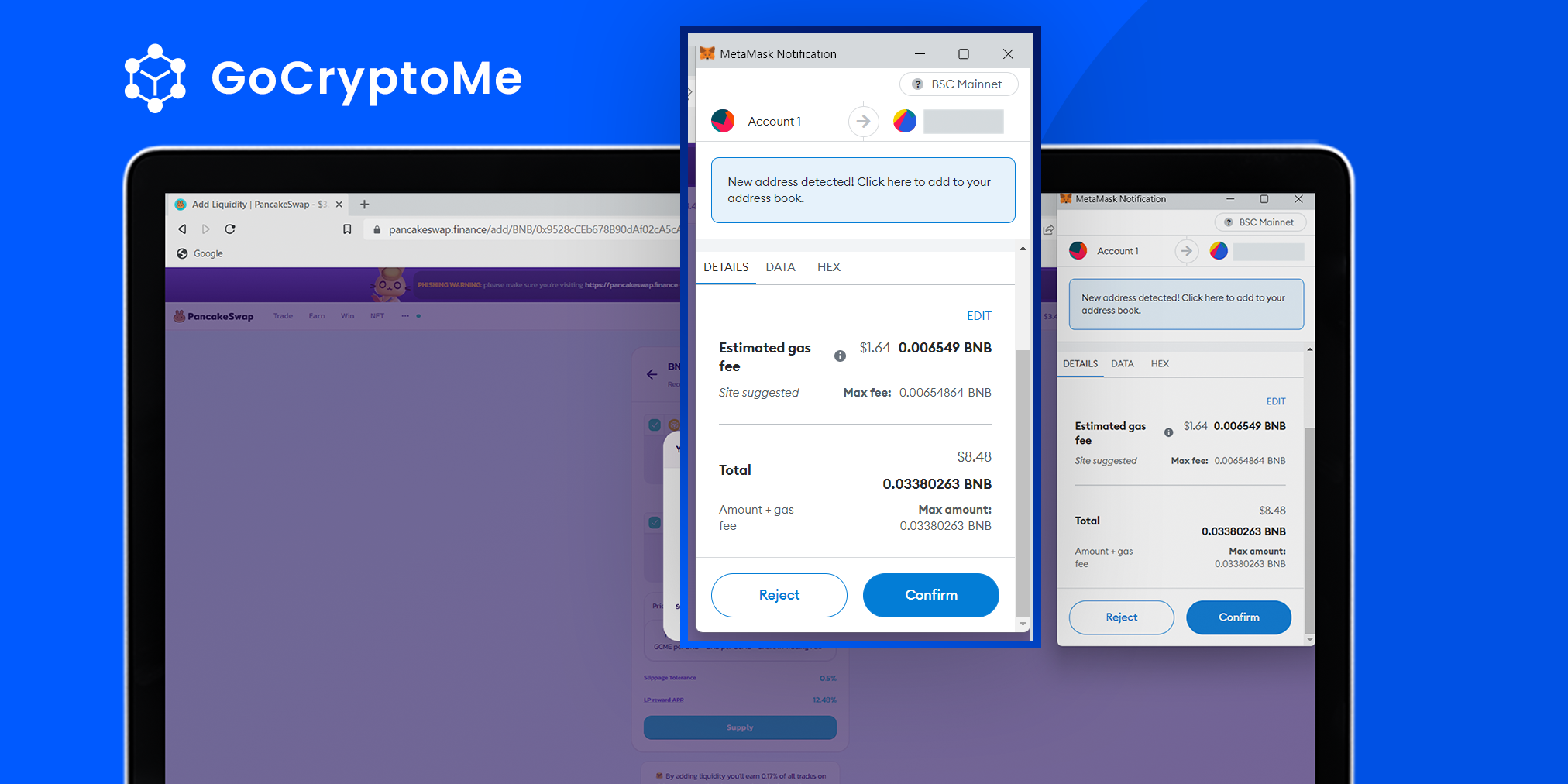

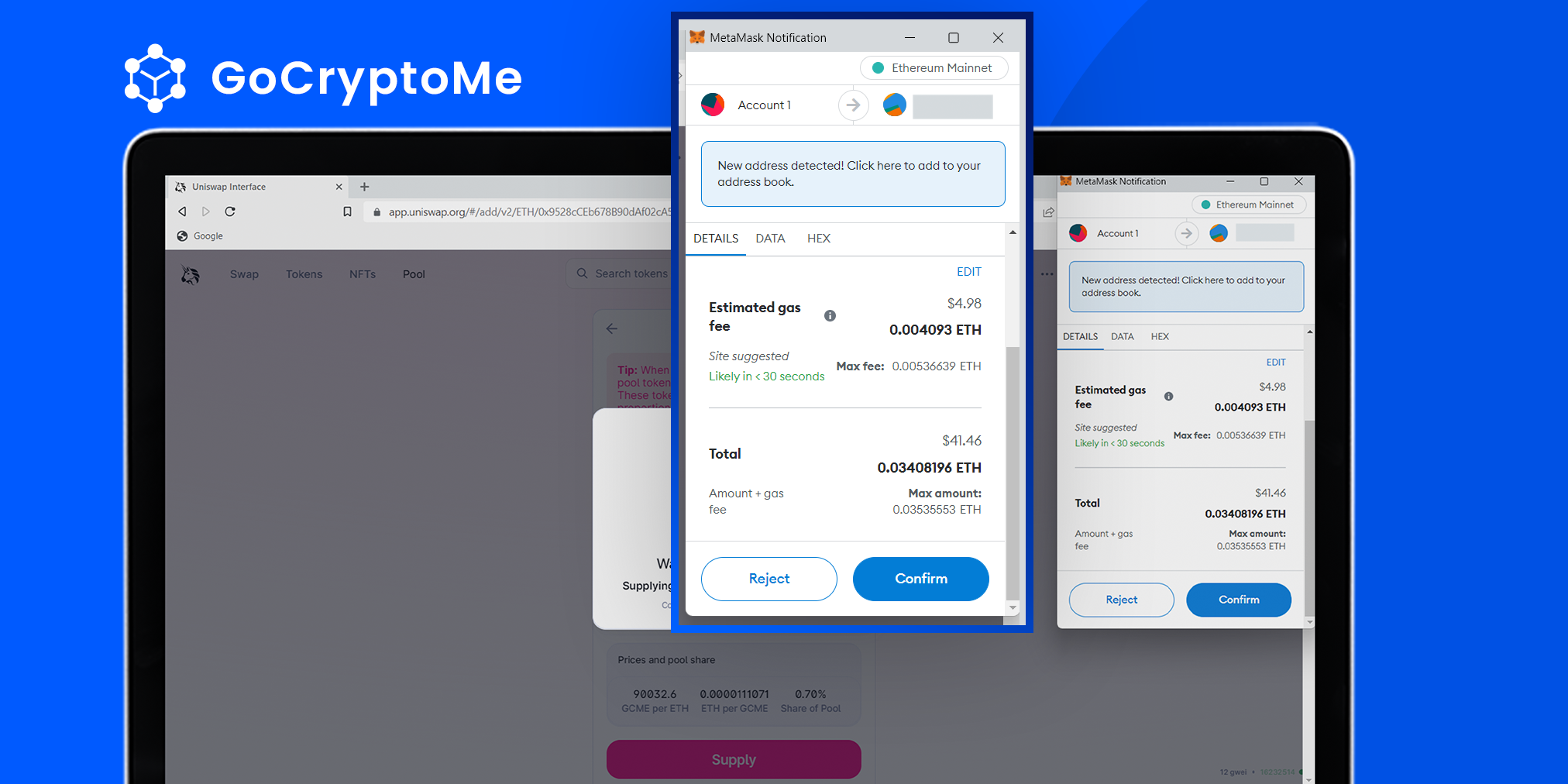

When you’re happy with the amount of tokens you’ll use to create the pair, you’ll need to approve the transaction in your wallet. Click ‘Enable GCME’ on PancakeSwap or ‘Approve GCME’ on Uniswap and approve the pop up confirmation in your wallet.

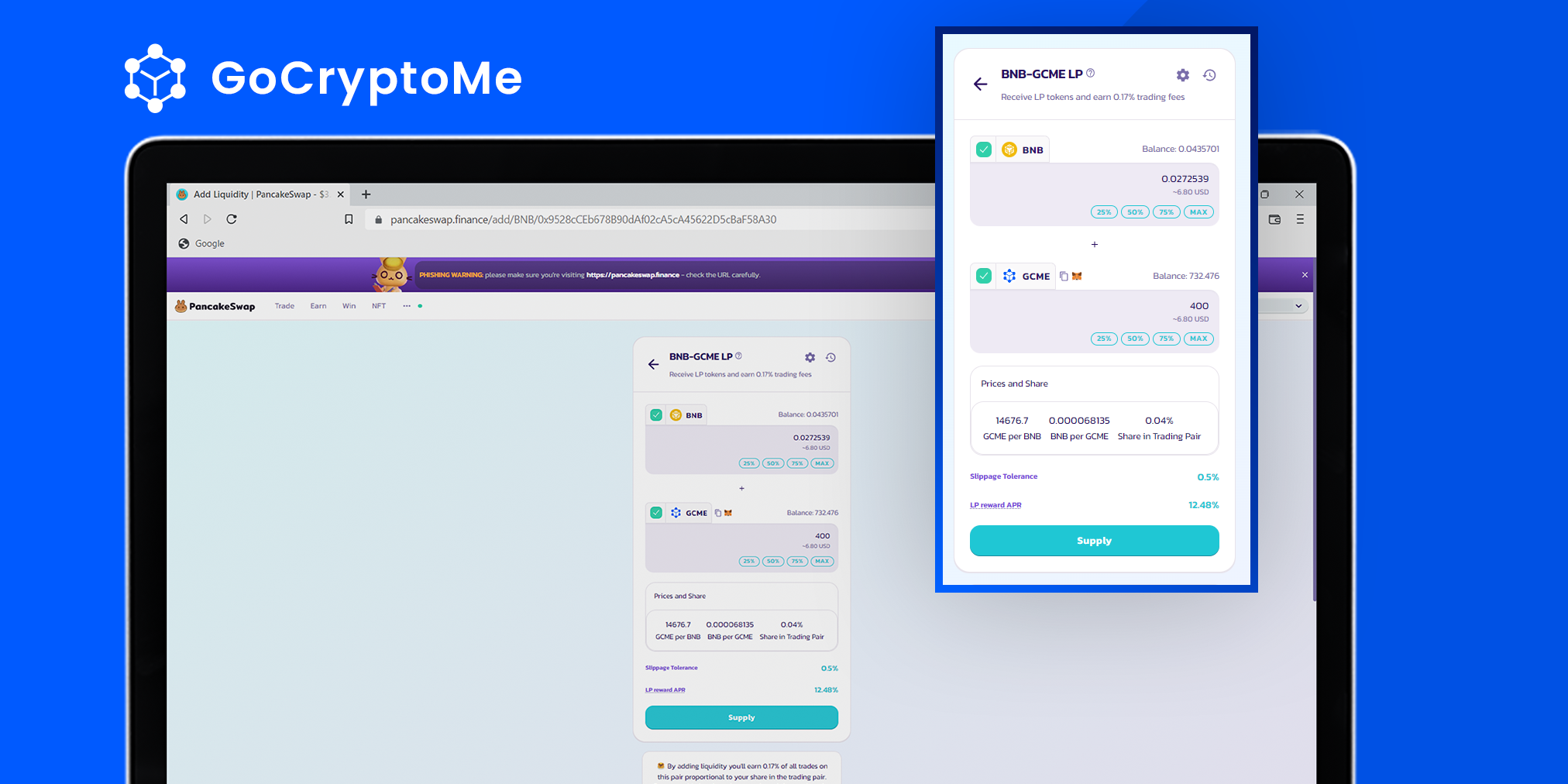

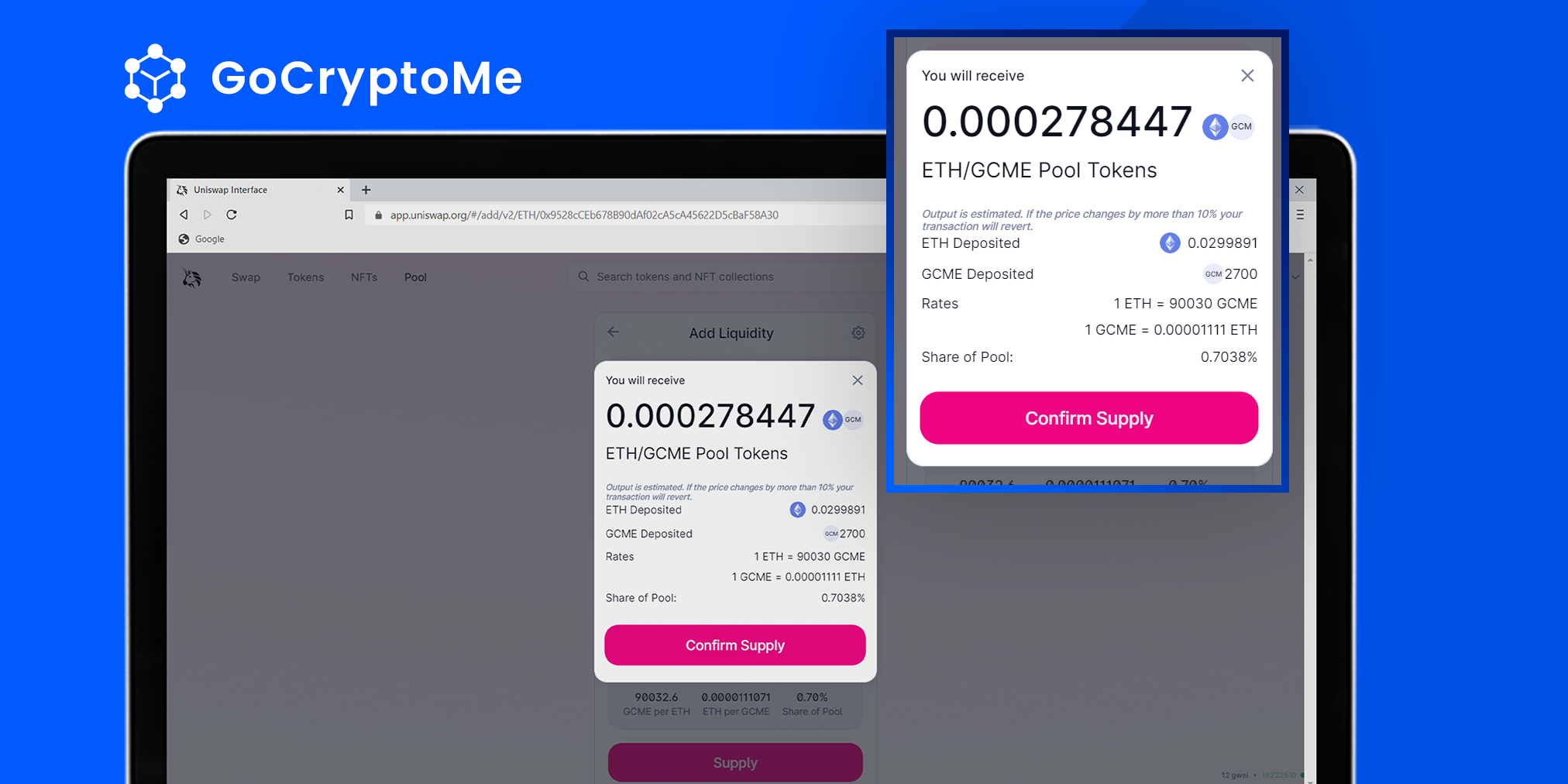

After a few seconds, the transaction will go through and you can click ‘Supply’, followed by ‘Confirm Supply’ to create the liquidity pair. You’ll receive another prompt in your crypto wallet to confirm the transaction.

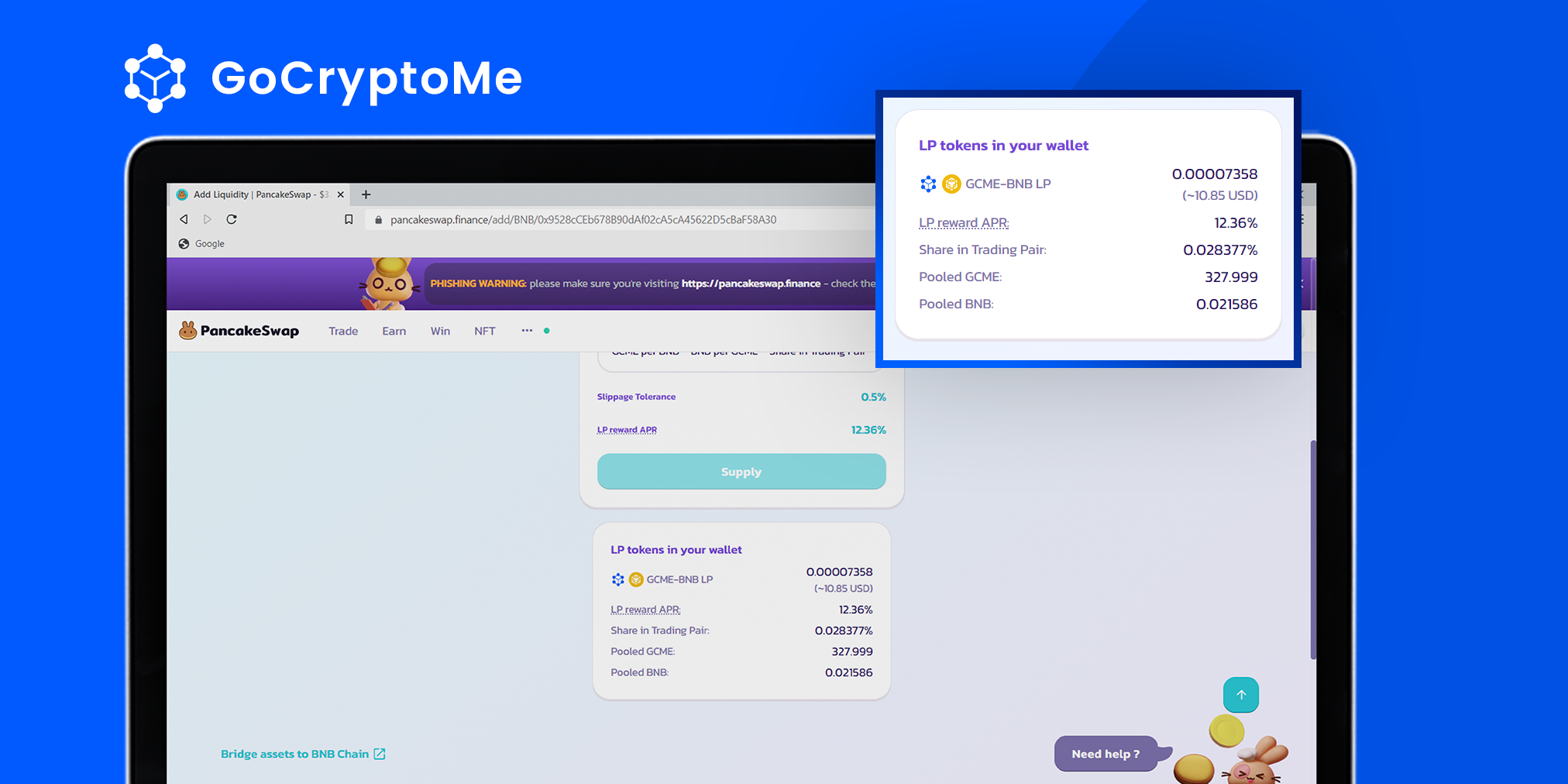

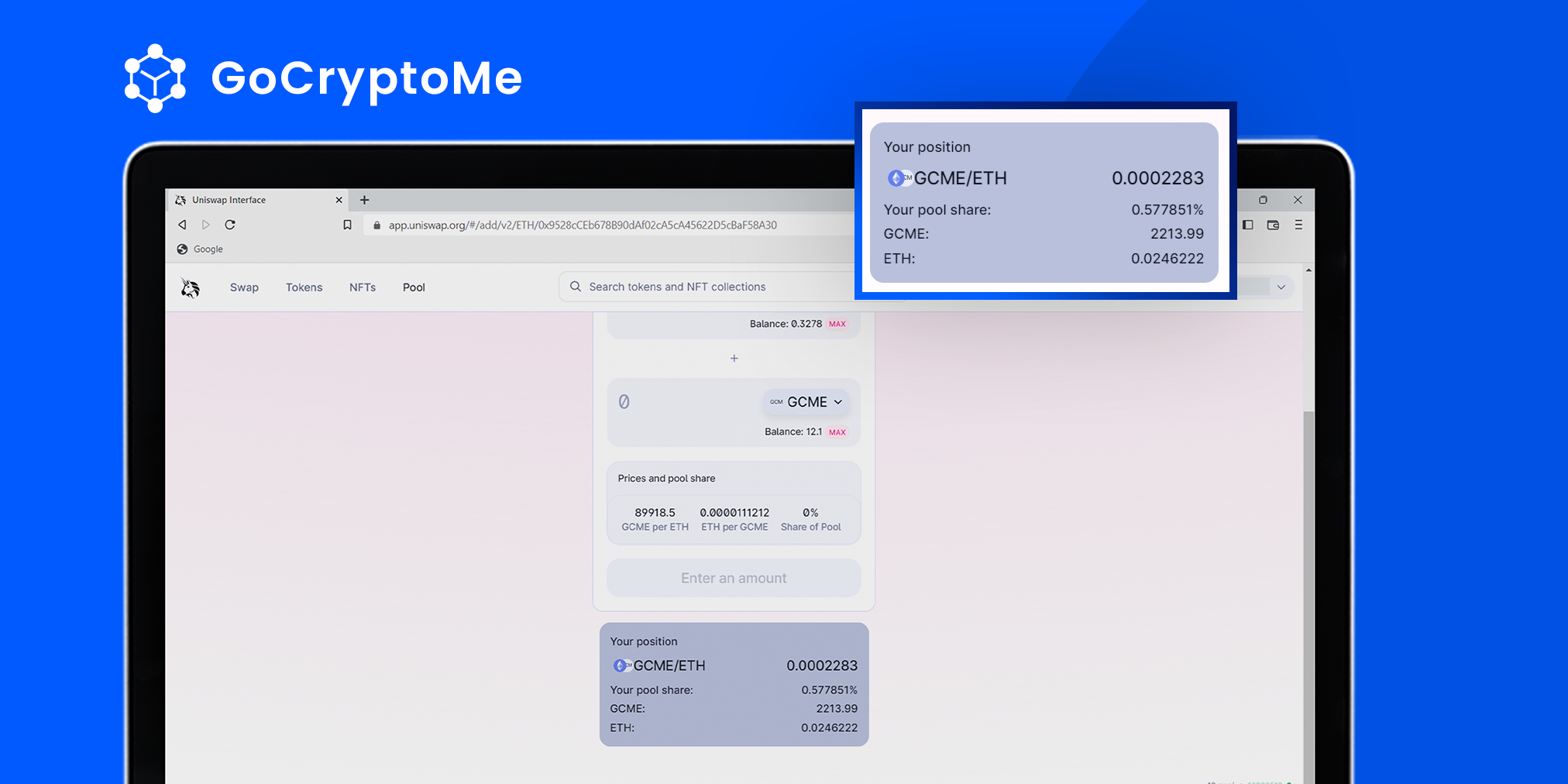

After a few seconds, your transaction should be confirmed. You can verify that your Liquidity Piar has been successfully created by scrolling down the page slightly and seeing how many LP tokens are now in your wallet.

Step 4: Earn Rewards

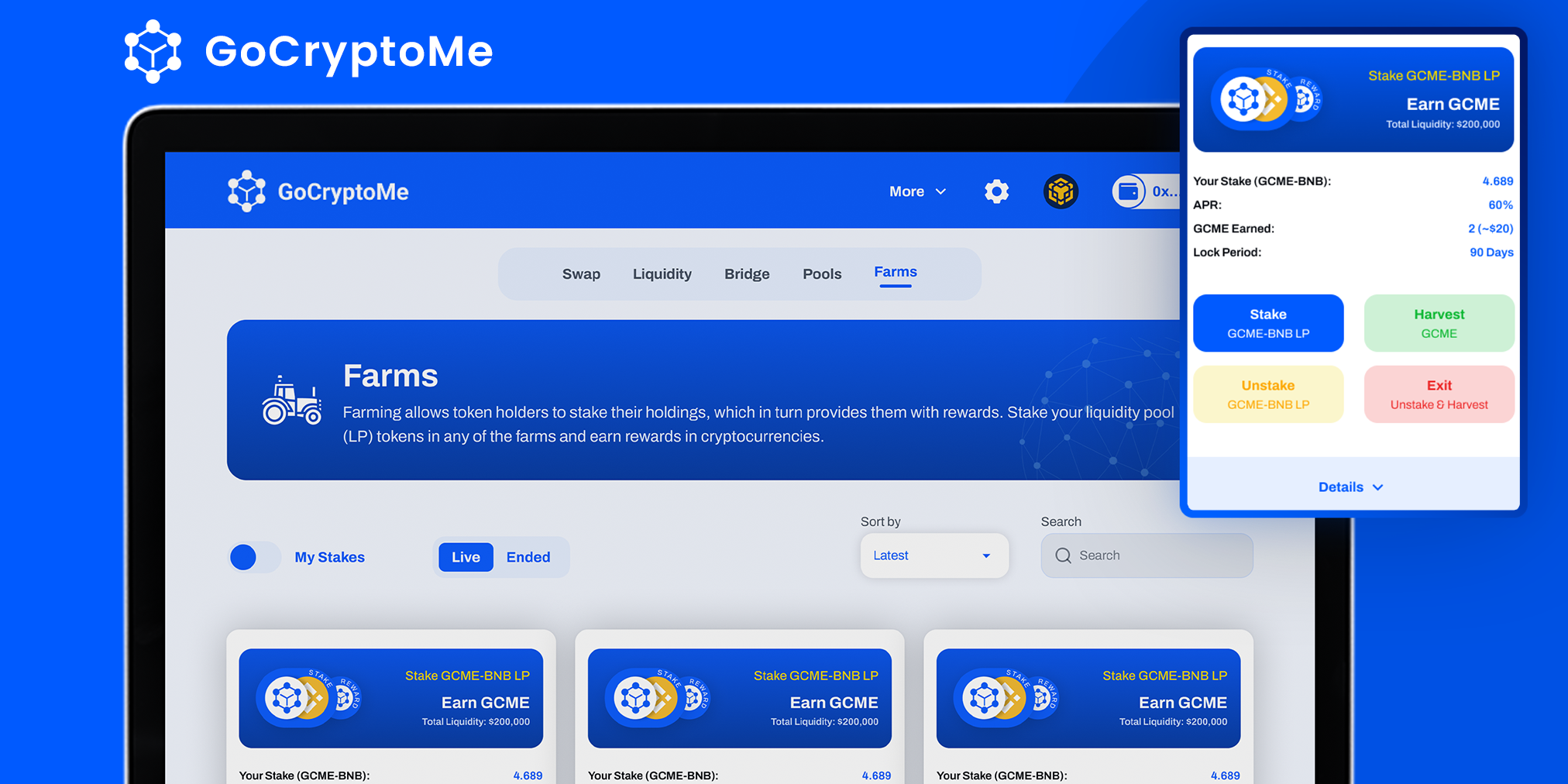

Now that you’ve successfully created your liquidity pair, you can deposit them into incentivized yield farms on sites like Pancakeswap or GoCryptoMe to earn extra tokens.

Summary

Congratulations! You’ve just created a liquidity pair and started earning crypto through yield farming.

Providing liquidity is a great way to earn passive income through decentralized finance while supporting innovative crypto projects. Creating distributed and deep liquidity helps to stabilize a tokens price and reduce volatile price impact, reinforcing a token like $GCME’s growth.

However, it is crucially important that you understand the risks associated with liquidity provision before committing and depositing funds into a pool. Issues like lock-up periods and impermanent loss can catch new users unawares, so please ensure you double check the conditions of a liquidity pool before depositing tokens.